Life insurance

Life coverage (or life confirmation, particularly in the Commonwealth of Nations), is an agreement between a protection arrangement holder and a back up plan or assurer, where the safety net provider guarantees to pay an assigned recipient an aggregate of cash (the advantage) in return for a premium, upon the passing of a safeguarded individual (regularly the strategy holder). Contingent upon the agreement, different occasions, for example, terminal disease or basic ailment can likewise trigger installment. The arrangement holder ordinarily pays a premium, either routinely or as one singular amount. Different costs, for example, burial service costs, can likewise be incorporated into the advantages.

Life arrangements are legitimate contracts and the terms of the agreement depict the restrictions of the guaranteed occasions. Particular rejections are regularly built into the agreement to constrain the risk of the safety net provider; basic illustrations are claims identifying with suicide, extortion, war, revolt, and common upheaval.

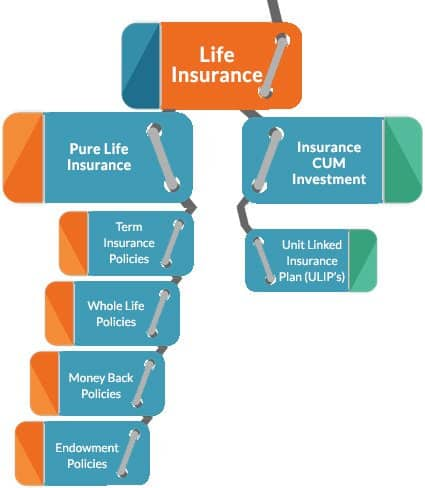

Life-based contracts tend to fall into two noteworthy classifications:

Security approaches – intended to give an advantage, regularly a singular amount installment, in case of a predetermined event. A typical shape - more typical in years past - of a security strategy configuration is term protection.

Speculation approaches – the fundamental goal of these arrangements is to encourage the development of capital by consistent or single premiums. Basic structures (in the U.S.) are entire life, widespread life, and variable life approaches.

History

An early type of extra security dates to Ancient Rome; "entombment clubs" took care of the expense of individuals' burial service costs and helped survivors monetarily. The principal organization to offer life coverage in present day times was the Amicable Society for a Perpetual Assurance Office, established in London in 1706 by William Talbot and Sir Thomas Allen. Each part made a yearly installment for every offer on one to three offers with thought to age of the individuals being twelve to fifty-five. Toward the finish of the year a bit of the "neighborly commitment" was separated among the spouses and offspring of perished individuals, in extent to the quantity of offers the beneficiaries claimed. The Amicable Society began with 2000 members.

The principal life table was composed by Edmund Halley in 1693, however it was just in the 1750s that the important numerical and factual devices were set up for the improvement of present day life coverage. James Dodson, a mathematician, and statistician, attempted to build up another organization went for accurately counterbalancing the dangers of long haul life affirmation arrangements, in the wake of being denied admission to the Amicable Life Assurance Society in light of his propelled age. He was unsuccessful in his endeavors at securing a sanction from the legislature.

His follower, Edward Rowe Mores, could build up the Society for Equitable Assurances on Lives and Survivorship in 1762. It was the world's first shared safety net provider and it spearheaded age construct premiums based with respect to death rate laying "the structure for logical protection hone and development" and "the premise of present day life confirmation whereupon all life affirmation plans were along these lines based".

Mores additionally gave the name statistician to the main authority - the soonest referred to reference to the position as a business concern. The main current statistician was William Morgan, who served from 1775 to 1830. In 1776 the Society did the main actuarial valuation of liabilities and therefore conveyed the primary reversionary reward (1781) and interval reward (1809) among its members. It likewise utilized consistent valuations to adjust contending interests. The Society looked to treat its individuals evenhandedly and the Directors endeavored to guarantee that policyholders got a reasonable profit for their ventures. Premiums were controlled by age, and anyone could be conceded paying little heed to their condition of wellbeing and other circumstances.

Disaster protection premiums written in 2005

The offer of disaster protection in the U.S. started in the 1760s. The Presbyterian Synods in Philadelphia and New York City made the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759; Episcopalian clerics sorted out a comparable store in 1769. In the vicinity of 1787 and 1837 more than two dozen extra security organizations were begun, yet less than about six survived. In the 1870s, military officers joined together to establish both the Army (AAFMAA) and the Navy Mutual Aid Association (Navy Mutual), propelled by the situation of dowagers and vagrants left stranded in the West after the Battle of the Little Big Horn, and of the groups of U.S. mariners who passed on adrift.

Costs, insurability, and underwriting

The insurance agency figures the approach costs (premiums) at a level adequate to subsidize claims, take care of authoritative expenses, and give a benefit. The cost of protection is resolved utilizing mortality tables figured by statisticians. Mortality tables are factually based tables demonstrating expected yearly death rates of individuals at various ages. Put essentially, individuals will probably bite the dust as they get more established and the mortality tables empower the insurance agencies to ascertain the hazard and increment premiums with age appropriately. Such gauges can be essential in tax collection control.

In the 1990s, the SOA 1975– 80 Basic Select and Ultimate tables were the average reference focuses, while the 2001 VBT and 2001 CSO tables were distributed all the more as of late. And in addition the essential parameters of age and sexual orientation, the more up to date tables incorporate separate mortality tables for smokers and non-smokers, and the CSO tables incorporate separate tables for favored classes.

The mortality tables give a standard to the cost of protection, however the wellbeing and family history of the individual candidate is additionally considered (aside from on account of Group approaches). This examination and coming about assessment is named guaranteeing. Wellbeing and way of life questions are asked, with specific reactions potentially justifying further examination. Particular factors that might be considered by guarantors include:

Individual therapeutic history

Family therapeutic history

Driving recor

Tallness and weight lattice, also called BMI (Body Mass Index)

In light of the above and extra factors, candidates will be set into one of a few classes of wellbeing evaluations which will decide the premium paid in return for protection at that specific transporter.

Disaster protection organizations in the United States bolster the Medical Information Bureau (MIB), which is a clearing place of data on people who have connected for life coverage with taking an interest organizations over the most recent seven years. As a major aspect of the application, the safety net provider regularly requires the candidate's consent to acquire data from their doctors.

The mortality of endorsed people rises significantly more rapidly than the all inclusive community. Toward the finish of 10 years, the mortality of that 25-year-old, non-smoking male is 0.66/1000/year. Thus, in a gathering of one thousand 25-year-old guys with a $100,000 arrangement, all of normal wellbeing, a disaster protection organization would need to gather around $50 a year from every member to cover the moderately few expected cases. (0.35 to 0.66 expected passings in every year x $100,000 payout per demise = $35 per approach). Different costs, for example, regulatory and deals costs, additionally should be considered when setting the premiums. A 10-year arrangement for a 25-year-old non-smoking male with favored restorative history may get offers as low as $90 every year for a $100,000 approach in the focused US life coverage showcase.

The greater part of the income got by insurance agencies comprises of premiums, yet income from contributing the premiums shapes a vital wellspring of benefit for most life coverage organizations. Gathering Insurance arrangements are a special case to this.

In the USA, extra security organizations are never lawfully required to give scope to everybody, except for Civil Rights Act consistence prerequisites. Insurance agencies alone decide insurability, and a few people are considered uninsurable. The arrangement can be declined or appraised (expanding the top notch add up to make up for the higher hazard), and the measure of the superior will be corresponding to the face estimation of the strategy.

Many organizations isolate candidates into four general classes. These classes are favored best, favored, standard, and tobacco. Favored best is saved just for the most beneficial people in the overall public. This may mean, that the proposed protected has no antagonistic medicinal history, isn't under pharmaceutical, and has no family history of early-beginning disease, diabetes, or other conditions.[19] Preferred implies that the proposed guaranteed is right now under solution and has a family history of specific ailments. The vast majority are in the standard class.

Individuals in the tobacco class normally need to pay higher premiums because of the higher mortality. Late US mortality tables anticipate that around 0.35 out of 1,000 non-smoking guys matured 25 will bite the dust amid the principal year of a policy.[20] Mortality roughly copies for each additional ten years old, so the death rate in the main year for non-smoking men is around 2.5 out of 1,000 individuals at age 65.[20] Compare this with the US populace male death rates of 1.3 for every 1,000 at age 25 and 19.3 at age 65 (without respect to wellbeing or smoking status).

Permanent life insurance

Permanent life insurance is life insurance that covers the remaining lifetime of the insured. A permanent insurance policy accumulates a cash value up to its date of maturation. The owner can access the money in the cash value by withdrawing money, borrowing the cash value, or surrendering the policy and receiving the surrender value.

The three basic types of permanent insurance are whole life, universal life, and endowment.

Whole life

Life insurance

![Life insurance]() Reviewed by @Book

on

October 27, 2017

Rating:

Reviewed by @Book

on

October 27, 2017

Rating:

No comments: